On 23 November Stellar announced that Stellar USDC had gone live on Fireblock, the platform for digital asset management. "Partnerships like this enable greater adoption of Stellar USDC by institutions and provide more ways for wallets and partners to build on Stellar," read the statement. The round is open for applications until 21 November. Stellar has also allocated close to four million XLM coins to the ninth round of its Stellar Community Fund, which is distributed to projects building on Stellar based on a community vote. On 25 October, the Stellar Development Foundation reported that global payments technology company Flutterwave has worked with the digital money transfer business TEMPO to launch two new remittance corridors on the Stellar network between Africa and Europe using Stellar USDC. The news followed an announcement on 29 September that digital banking company VersaBank and Canadian blockchain fintech company Stablecorp plan to launch a Canadian stablecoin, VCAD, on the Stellar network. The pilot also lets participants exchange Stellar USDC for any cash currency supported on the MoneyGram platform." On 17 November MoneyGram announced the project had "hit the first major milestone" with the launch of a live cash-in and cash-out pilot in the USA. According to the statement: "Pilot participants can now deposit cash into their digital wallets at participating MoneyGram locations and send payments internationally via Stellar USDC. The integration will also enable MoneyGram to settle transactions in near real-time, improving efficiency and reducing risk. Customers will be able to use USDC for cash funding and payout in local currencies. But on 6 October, the companies announced a partnership to integrate MoneyGram's network with the Stellar blockchain and facilitate payments using Circle's USD stable coin USDC.

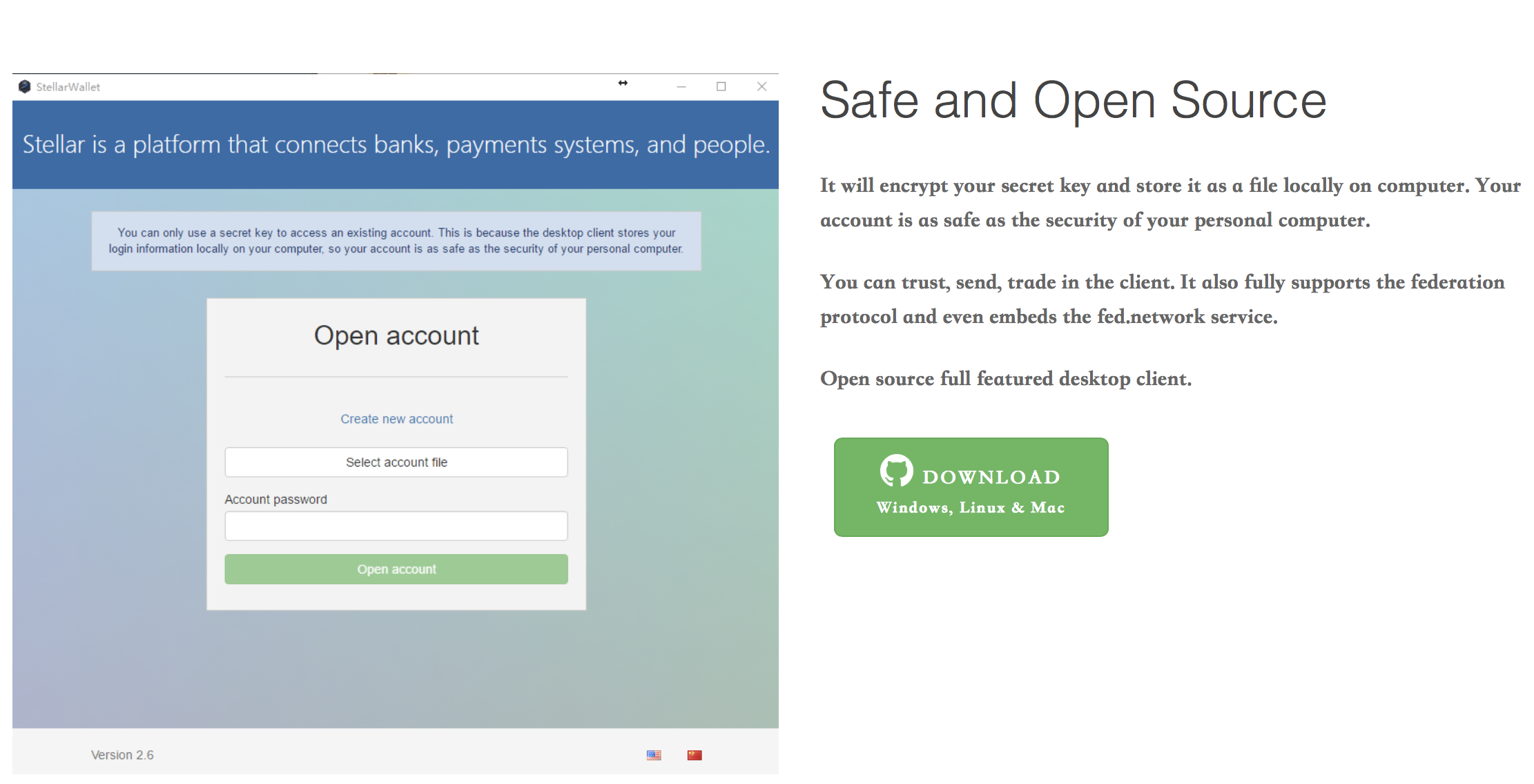

Stellar exchange client upgrade#

If approved, the upgrade will go live at that time.īloomberg reported in July that Stellar had approached US-based global payment remittance giant Moneygram International about a potential takeover in partnership with private equity company Advent International. Validators will vote on a public launch on 3 November. AMMs improve network liquidity, which is part of the 2021 growth plan on Stellar’s development roadmap.

On 6 October, the Stellar testnet was upgraded to prepare for the release of Stellar Protocol 18, which will enable developers to create automated market makers (AMMs) on Stellar. Financial institutions around the world can settle payments and issue assets on the decentralised and scalable network. The Stellar Development Foundation (SDF) has partnered with some of the biggest companies in finance and tech, including Deloitte, IBM and Stripe, as well as a dozen financial institutions and payment processors in Asia and Europe. Low transaction fees aim to allow users to transfer money quickly without incurring extra processing costs. “These are small enough to keep Stellar widely accessible, but big enough to discourage large-scale bad behaviour.” Users must hold a minimum balance of one lumen and pay a minimum transaction fee of 0.00001 lumen. The lumen, or XLM coin, is the network’s native coin.

Stellar exchange client code#

It was based on the Ripple Labs protocol – the Stellar blockchain was a hard fork, or split, from the Ripple blockchain, and the code was re-written. The blockchain enables fiat currencies and other assets to run in parallel with each other and cryptocurrencies, making it easier to transfer fiat currency into crypto. Launched in July 2014, Stellar aims to narrow the gap between cryptocurrencies and traditional finance. Stellar enables low-cost international transactions

In this article, we look at the latest Stellar Lumens news and the XLM price. Is the lumens crypto price consolidating ahead of a return to some gains, or is now the time to sell it short?

The coin's price has been keeping to a fairly tight price band between $0.24 and $0.3 since early December.

Stellar exchange client series#

XLM, the coin of Stellar Lumens, is showing a series of declining spikes over the last two months and there is little indication it could return to sustained growth any time soon.

0 kommentar(er)

0 kommentar(er)